Your parents called, they wanted to know how your job search is going? Okay, they didn’t call, but with the semester winding down, you should expect to get that question in the not-too-distant future. If the thought of starting your part-time job search sounds about as much fun as another year of online classes, don’t worry – we ? got ? you!

We made a list of easy part-time jobs for college students, and how to find them – check out our lists below.

Whether it’s your first time, or you’ve done it like a thousand times before (no judgment), you should know that it’s totally normal to not know what you’re doing. Sure, you may have a general idea of what’s supposed to go where, but if you aren’t careful, everyone involved is going to end up tired, sweaty, and disappointed.

Lucky for you, we have just the tips to help make your next move easy peasy, lemon squeezy. Without further adieu, here are our tips for things you can do to make moving into your place easier (*if you don’t have one yet, check out this post about what to look for in your first apartment).

First Base – Kiss The Mess Goodbye

Whether you consider yourself a “neat freak” or your friends/family members have submitted you to the show Hoarders, you need to clean up your current situation. Until you start trying to deep clean your current place, you won’t realize how much junk you’ve accumulated in the last few months. Do yourself a favor and start your cleaning early. Not only will this help make your move easier, but it’ll also help reduce the chances of losing a chunk of your security deposit for a cleaning fee. For more tips on how to save your security deposit, click here.

Pro tip: If you haven’t worn or used the item in question, donate it, sell it, or toss it.

Continue reading

When it comes to off-campus housing there are a few things most students agree on that they want, one is being close to campus, and the other is something affordable. Of course, having certain amenities like a dishwasher, parking, and more are all added bonuses. College is already expensive and the last thing a student wants is more expenses. Whether you prefer to live alone or with a couple of friends, there are options that won’t burn a hole in your wallet!

Continue reading

When it comes to finding off-campus housing, it’s important to student renters that they find a place they like, is close to campus, and won’t run your (or your parents’) pockets dry. Between the costs of tuition, books, housing, and all of the other expenses that go along with being a student, it can almost seem like you’ll be paying off loans until the end of time. To help cut costs, you should consider getting a roommate or two, but you can also try looking at some options that are totally affordable for the average student.

Continue readingWhether you’re looking for a State College, PA house for you and four of your friends or a studio apartment for you and well, just you, know that off-campus housing doesn’t have to be expensive! Everyone knows the cost of being a college student isn’t cheap, but that doesn’t mean you can’t find affordable housing near Penn State.

Continue reading

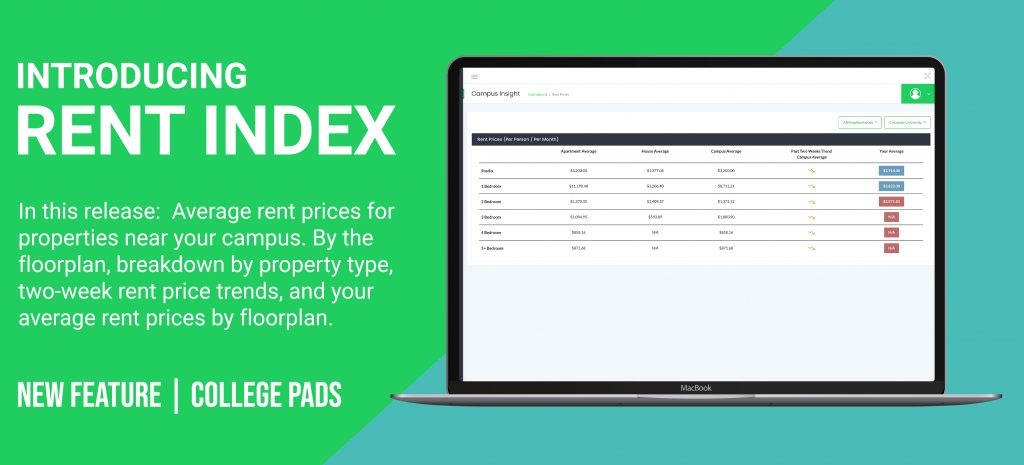

When setting the rates for your rental properties, you have to make sure your rent prices are set high enough so you can cover costs associated with being a landlord (like your mortgage, insurance, taxes (*sigh*), maintenance), but also be low enough to be competitive in the market.

Yeah, we know – that’s a lot easier said than done.

But as a College Pads customer, finding the sweet spot for rent prices is about to get a little easier with Rent Index. Check out how the Rent Index will help you stay competitive in your market!

Generally speaking, turning over a rental property takes a landlord or property manager between 9 to 10 days. But with a little planning, you can easily streamline the turnover process and get it ready for the next round of tenants, saving you time and money.

Here are 5 easy tips for streamlining rental turnover:

Tip #1: Communicate With Tenants

Continue readingWhat To Do Before, During, & After Tenant Turnover

If you were lucky, a majority of your tenants decided to renew their leases and stick around for another year. If you weren’t so lucky, the dreaded tenant turnover process is right around the corner. While the anxiety of getting one group of tenants out, and another group in may be keeping you up at night, there are definitely things you can do to make the process easier on yourself.

Here are a few things you should make sure you’re doing before, during, and after tenant turnover:

You’re doing it. You’re really doing it. You made it out of high school and now you’re killing it in college. You’re on track to graduate in four years and you’re feeling good about your major… Or you’re on track for a six-year stay at college because you keep switching your major, and you’re not even sure this most recent one suits you. But man, you gotta get out of here eventually, so you’ll settle for any degree at this point. When you’re done with this whole college thing, finding a job will be no problem… Or will it?

Continue reading

Off-campus housing tends to be a more budget-friendly living option for students than living on-campus. Not only that, but when you choose to live in an apartment or house off-campus, you’ll have more space and freedom than when you lived in the dorms. The drawback to college apartments and houses is that they can be a little run down – by that, we mean that the walls have seen some things. But hey, living in a beat-up rental is kind of a part of the college experience.

Just because you can’t afford to rent a swanky apartment or house near campus doesn’t mean that you can’t find ways to make your rental your own. Without further adieu, here are a few tips on ways you can make your college apartment not look like a college apartment.

Tip #1: Buy a plant (or two)

College Pads recently surveyed thousands of college students to find out what they they like and what they don’t like when it comes to leasing their next off-campus pad.

The three things that mattered the most to them when searching?

Continue reading